The Great Refunding

Treasury Auctions Next Week

Sometimes corporations find it helpful to restructure their debt. In times of lower interest rates corporations may call in older issued debt. They will refund the borrowers, and they may issue new debt at the lower interest rate. This process is called refunding.

Bloomberg reports that the US treasury plans to sell a record amount of bonds this coming week. The Week of February 8, 2021 the US treasury plans to sell $126 billion of long-term debt. After refunding existing debts $63.1 billion is expected to be left as new cash.

According to TreasuryDirect an exhaustive list of all treasury auctions this week is:

-

$27 billion of 30 year bonds

- Auction Feb 11, Issuance Feb 16

-

$41 billion of 10 year notes

- Auction Feb 10, Issuance Feb 16

-

$58 billion of 3 year notes

- Auction Feb 9, Issuance Feb 16

-

$51 billion of 26 week bills

- Auction Feb 8, Issuance Feb 11

-

$30 billion of 119 day Cash Management Bills (CMB)

- Auction Feb 9, Issuance Feb 11

-

$54 billion of 13 week bills

- Auction Feb 8, Issuance Feb 11

-

$30 billion of 42 day Cash Management Bills (CMB)

- Auction Feb 9, Issuance Feb 11

The first three items on this list is the $126 billion of long-term debt that the treasury has announced the auction of this week. The last four items amount to $165 billion of shorter-term debt set for auction this week. Each item includes the auction date and the issuance date. On the auction day auction participants may hedge their bid by placing a trade on the open market. After issuance the securities will be available for direct selling on the market.

The Yield Curve

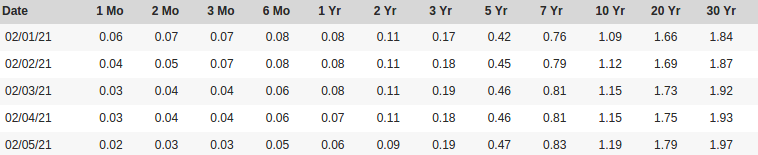

One of the confusing things about interest rates is that there are so many different types of interest rates. Even when only talking about government debt, there is a whole curve of interest rates to report. The government generally pays more interest on loans for a longer period of time. This table shows the yield curve for five recent days as reported by the treasury.

These data show a clear trend. Treasury yields for periods of 2 years or less have been falling. Treasury yields for periods of 3 years or more are rising. The current refunding of the treasury was done to replace shorter term loans with longer term loans. A reduction of the supply of shorter term bills could explain a reduction in short-term yields.

The recent changes in treasury yields may reflect a pricing in of the expected auction next week. It's also possible that the auction is not fully priced in and the trend will continue.

Darren Tapp

Darren Tapp